All Categories

Featured

[/image][=video]

[/video]

Withdrawals from the cash money worth of an IUL are typically tax-free up to the amount of premiums paid. Any kind of withdrawals over this amount might be subject to tax obligations depending on policy structure.

Withdrawals from a Roth 401(k) are tax-free if the account has actually been open for at the very least 5 years and the person mores than 59. Possessions withdrawn from a typical or Roth 401(k) before age 59 might incur a 10% fine. Not exactly The claims that IULs can be your own financial institution are an oversimplification and can be misinforming for lots of factors.

You might be subject to upgrading linked health and wellness inquiries that can influence your continuous costs. With a 401(k), the money is constantly yours, consisting of vested employer matching no matter whether you give up contributing. Danger and Guarantees: Firstly, IUL plans, and the cash money worth, are not FDIC guaranteed like common checking account.

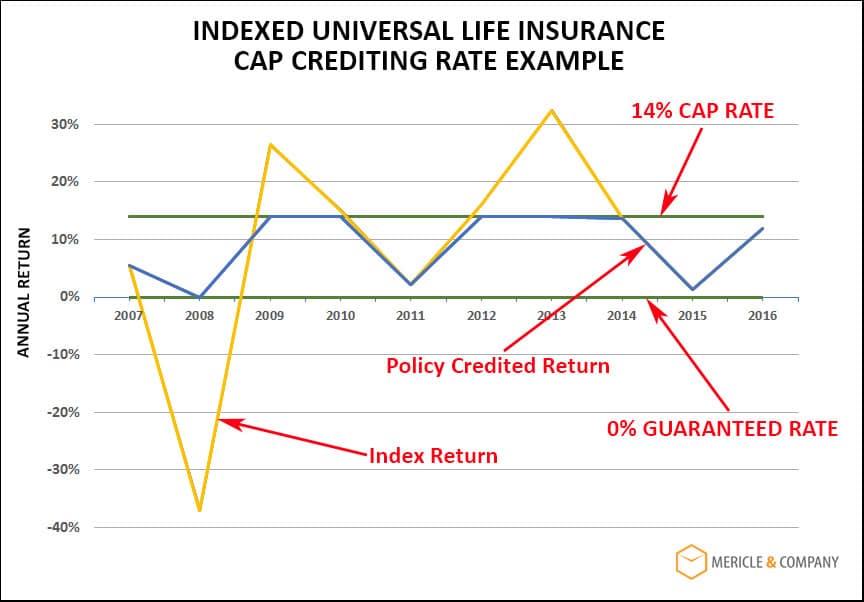

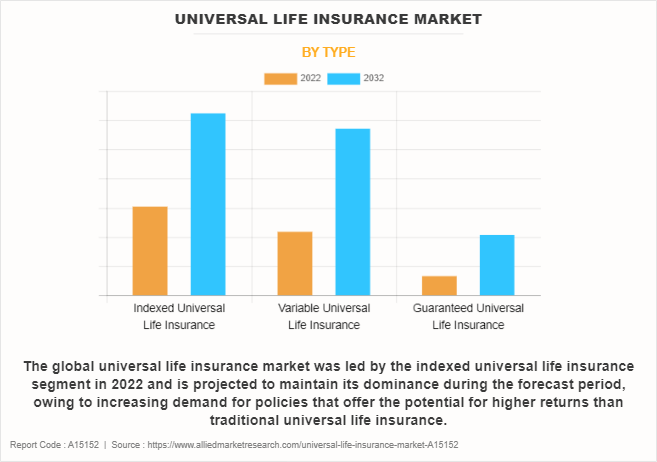

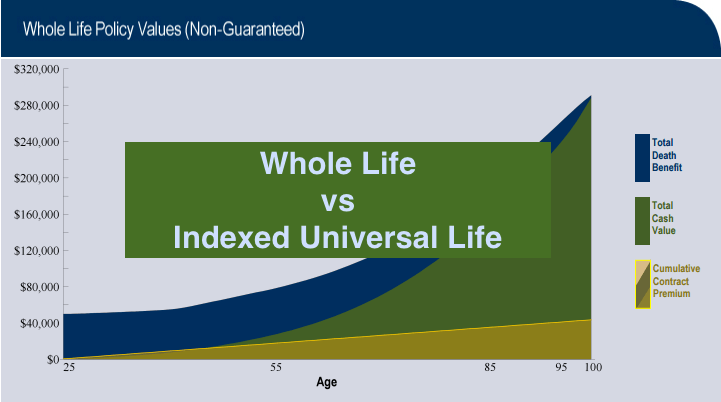

While there is generally a flooring to avoid losses, the development possibility is covered (meaning you might not completely take advantage of market growths). A lot of experts will agree that these are not comparable items. If you want death advantages for your survivor and are concerned your retirement savings will not suffice, after that you might want to take into consideration an IUL or other life insurance policy item.

Certain, the IUL can provide accessibility to a cash money account, however once again this is not the main objective of the product. Whether you desire or need an IUL is a highly private question and depends on your primary financial purpose and goals. Nevertheless, below we will try to cover advantages and limitations for an IUL and a 401(k), so you can further delineate these items and make a much more educated decision pertaining to the very best means to take care of retired life and taking treatment of your enjoyed ones after death.

Allianz Indexed Universal Life

Financing Expenses: Financings against the plan build up rate of interest and, otherwise paid back, reduce the survivor benefit that is paid to the recipient. Market Engagement Limitations: For a lot of policies, investment development is linked to a stock exchange index, yet gains are usually covered, limiting upside potential - iul calculator excel. Sales Practices: These plans are often marketed by insurance representatives who might emphasize benefits without fully clarifying expenses and dangers

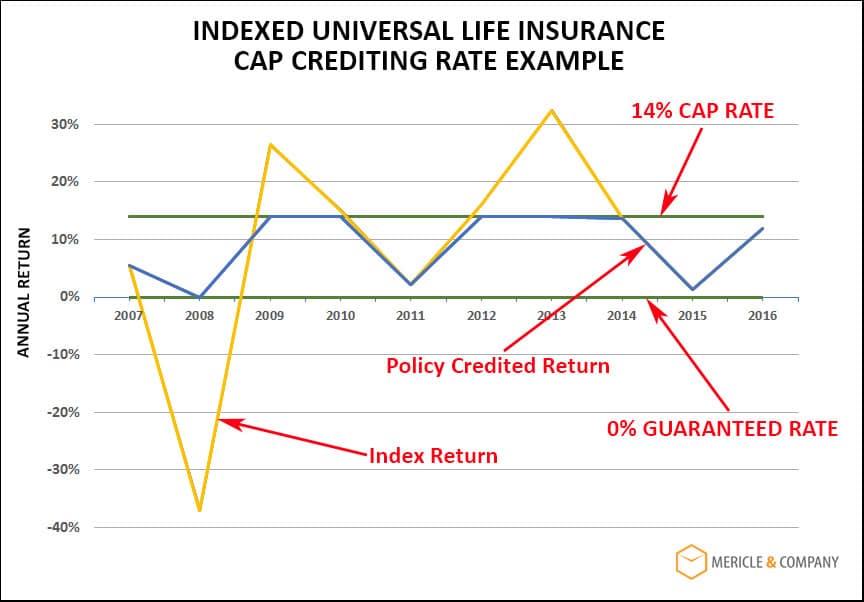

While some social media experts suggest an IUL is a substitute product for a 401(k), it is not. Indexed Universal Life (IUL) is a type of irreversible life insurance policy that additionally provides a money value element.

Latest Posts

Iul Life Insurance Reviews

Nationwide Indexed Universal Life Insurance

7702 Iul